The less-obvious options

When you configure Trading Pleb Trade Replicator in NinjaTrader (NT), you’ll be able to choose your Master account and Followers and any specific Follower Ratios (defined further below). We’re just covering the first few less-obvious options here:

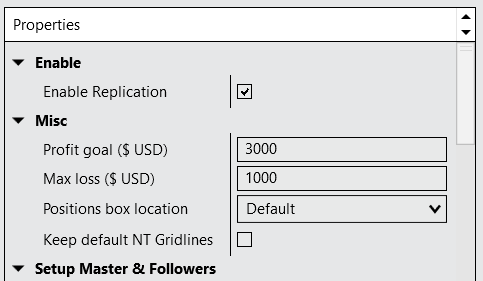

- Profit goal ($ USD). This will display your target goal for the day on your chart for your Master account.

- Max loss ($ USD). This displays the max loss you can take on your Master account before you should walk away.

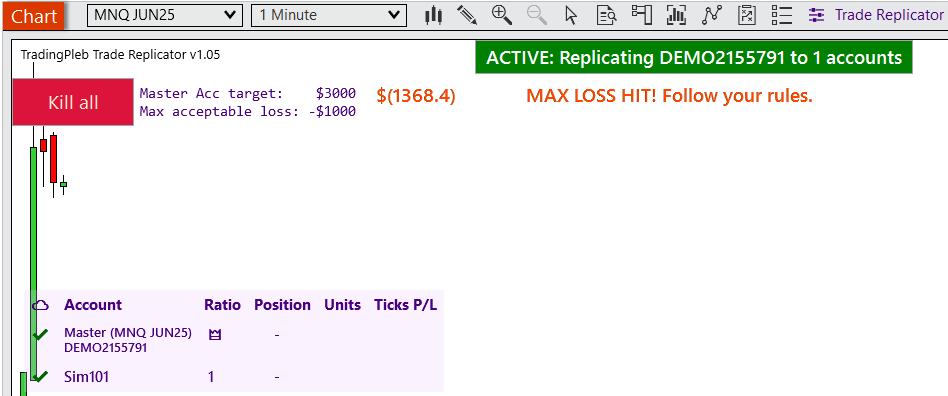

- If either of these two fields are filled, your total P&L is displayed on your chart. And if either figure is reached, a large text warning (or victory suggestion) to walk away is displayed. You can choose to use this feature to aid in risk management and/or your own trading rules adherence. The live P&L figure shown (orange if in drawdown [as per screenshot], green if in profit) reflects the NT “Total PnL” column in the “Accounts” tab on the NT “Control Center” default window.

- It’s the sum of Realized + Unrealized P/L.

- It Resets depending on your broker. For Tradovate and Rithmic, it’s Daily.

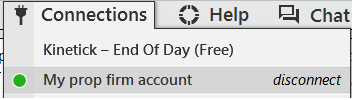

- Quickly Disconnect / Reconnect your Master account if you think its showing old data (if you keep NT running overnight).

- Leave these two described fields blank (default) to not show this data at all.

- Positions box location. Shifts the the purple box displaying your Follower positions.

- Keep default NT Gridlines. NinjaTrader has default grid lines that are removed.

What is this tool and a word of why it’s better than its other friends out there

This Replicator aims to be the most reliable out there.

Master = The one account you trade

Follower = One or many accounts you want to clone from Master

In fast-paced markets chaos happens with the other replicators out there; they try to copy and adjust limit orders and such to your followers, and they implode. They cost me so much money in software errors when these orders could not be cloned fast enough and strict broker / exchange requirements blocked the crazy actions these other copies were trying to do (like setting a Buy Limit order above Price – which is strictly disallowed across every market).

For example, if a user is chasing a long, up, by moving their Sell Stop upward in another trade copier, what happens is the Followers, with their Sell Stops still well below Price, will also get moved up to match the Master account. Great. However, if Price dumps in that interim moment (which happens a lot), the Followers are now having their Sell Stops being placed Above Price – which is strictly disallowed on any exchange/broker (a Sell Limit is used for that).

What happens with other trade copiers (and not Trading Pleb Trade Replicator, which is more like a 1999 Toyota Camry that keeps working) is all your Followers have now self-imploded themselves with Exchange/Broker rejections strictly disallowing the shenanigan’s of trying to set Sell Stops Above Price / Buy Stops Below Price. Some of your followers are now going the opposite way and some have no Stop at all now! Unlimited risk if short, and you will most certainly blow up a few prop accounts or fail their challenges, if long.

Now you’re in panic mode trying to get everything closed, or you get caught by greed because price temporarily returns back up your way and everything is in profit (not the followers that are backwards). Either way, your plans are now shot and emotions are running the show.

If you’ve used those tools and you scalp, you’ve probably experienced what I am talking about.

In order to be more reliable, and even tolerate high impact news events like CPI Y/Y, it required being as simple as possible, to remove as many channels for catastrophe as possible. This is why this tool does not use Limit Orders for followers. You can still use limits / bracket orders (take profit, stop and entry price set at same time) or any other fancy trading system / bot setup you want for your Master account, and these executions will be cloned to your Followers with lightning speed.

As those Master orders get executed, the followers will copy. Sometimes you get a better fill by a few ticks, sometimes worse by a few ticks, most of the time its the same. I find it all averages out over time and is not an actual concern. I found this approach far better than having 5 followers smash a brick wall, a few others going fully the opposite direction to my Master account – leaving me with an general out-of-control situation, because adjustments in a fast-paced market were rejected by the broker / exchange. I trade NQ, and that thing is even fast in Asia session.

This is the reality with the other replicators. Been there, done that. Not worth it. I’ll pay the 2 tick cost to not have this problem (half the time it’s the one paying me instead).

If you Swing Trade (though note very few prop firms allow swing / overnight trades), I would only then consider these other replicator options.

A word on Follower Ratio’s

This replicator does a solid job at not setting your Followers to go the opposite way. You would think, well, surely it should never do that? Yes, you would think that.

If for example, a Follower account has a ratio of 2 (so it trades double whatever Master trades – it’s 1:1 by default) and for some reason your Master account is live for 10 units and your follower is live for 15 units (which should never happen but its possible if already in a position across accounts, and then activating a replicator), that risk exists.

Continuing with this example, say you close 10 units on Master. In theory your follower should end up -5 units short in the market. This is what most Trade Copiers will do to you. This sort of sucks, that is not the spirit of what you want. Trading Pleb Trade Replicator will instead intelligently go flat at zero for that Follower – that is the goal.

Be aware of what you are doing and the different ratios you have set – if you have changed from the default 1:1 for one or more followers – especially if you are doing a bunch of wizardry. There’s only so many crazy user scenarios I can catch. And I promise this tool catches more than the other tools.

Partials

You can partial out of your Master account and this will also occur on your followers. E.g. You are 10 contracts long, and you take 3 off the table, your followers will also drop to 7 units long (if followers are 1:1 ratio for this example). Great.

There is subtle difference to point out when it comes to actual Entries. If you have a 10 contract Limit Long entry awaiting execution on your Master account, and all your followers for ease of example, have a 1:1 ratio to your Master account and price comes down and taps your Master account for 3 units, leaving 7 still out of the market – none of your followers will enter for 3 units. They will wait for all 10 to be filled, and then they will enter.

If your 3 unit tap happened to (by some miracle) go straight to your Take Profit, none of your followers will have ever entered that trade at all. I can count on one finger how many times that has happened. Once. All contracts of Master’s entry need to get filled or none will get filled on the Followers.

Why is this? Again it’s down to reliability. There are so many things that can go wrong and this unicorn event I described here happens so rarely (price almost always comes back and taps the full position in) that the channels of problems it creates is not worth that one out of one hundred times you face this event. I’m talking about that situation where you get in to the tick and it reverses back into your direction.

Almost always, partial entries will get re-tapped a minute later, well away from any take profit levels. Note: I could try support this unicorn event but I assessed the risk as not being worth the benefit. You would be horrified how unforgiving financial products are to errors or abnormalities of any kind. Sort of like building rockets, except the risk is money loss, rather than explosions.

TradingView and Prop firms using Tradovate

TRADOVATE BUGS

TLDR Summary:

1. Don’t manipulate trades across multiple platforms. Pick one.

2. Reconnect your accounts in NinjaTrader if you never switch your PC off. At least once every few days.

Avoid trading across the Tradovate website, TradingView and NinjaTrader at the same time. I.e. Don’t create an “ATM” strategy on Tradovate, and then shift the stop and partial out of positions in TradingView, and say shift your Take profit in NinjaTrader.

As of 2025, Tradovate has a lot of bugs. A big one are imaginary stops that appear in TradingView but when clicked on, fail, yet work within Tradovate directly. I have personally reported multiple bugs within TradingView when connected to Tradovate as they have cost me money. One gem is setting a stop order that is good for the day without realizing (the default for Tradovate) and the next day coming back, and seeing the Stop still exists in TradingView, thinking you are nice and safe, but actually the Stop doesn’t exist at all! I strongly doubt its TradingView’s fault.

TradingView blocks you having Tradovate connections across different windows – try it – it’s to avoid Tradovate bugs. Unfortunately these bugs make it down into NinjaTrader and can cause drama with replication, but you can stop them following the two steps above.

Tradovate bugs (cont)

Other than the basic rule of thumb of pick one platform and don’t manipulate a live trade across different software, the other one is if you ever see a popup from NinjaTrader saying “PANIC”, it typically means NinjaTrader (that this replicator runs on) has failed to get an Internet connection to the broker after a good while. This mostly happens over weekends if you leave your computer on 24/7.

In this case. Disconnect your prop account(s) and reconnect. It avoids Tradovate drama.

In real life these cautions are for infrequent bugs, but as you automatically look both ways before you cross a road, apply the above etiquette to avoid any issues.

If you have any issues using this Replicator, you can use the contact us page form to get help.